Open Door Financial loans and doorstep money lending have acquired level of popularity as practical and flexible choices for people needing fast financial aid. These types of lending solutions permit borrowers to obtain funds without needing to experience the standard, often prolonged, loan software procedures linked to banking institutions or other significant fiscal establishments. Although the appeal of these loans may well lie in their simplicity and accessibility, it’s crucial that you totally have an understanding of the mechanisms, positive aspects, and opportunity pitfalls prior to looking at this type of economic arrangement.

The idea powering open doorway financial loans revolves all over delivering easy and quickly use of money, generally with no want for considerable credit history checks or collateral. This makes these financial loans appealing to people who might not have the ideal credit history scores or individuals that encounter economical challenges. Contrary to regular loans that will take days or perhaps months being permitted, open up doorway financial loans typically supply dollars for the borrower’s account inside of a issue of hours. This pace and advantage are two in the most vital factors contributing on the increasing reputation of such lending solutions.

The entire process of applying for these loans is simple. Commonly, borrowers need to supply fundamental particular data, proof of profits, and bank facts. Considering that open up door financial loans are often unsecured, lenders take on extra chance by not demanding collateral. Because of this, the desire prices and charges associated with these loans are typically higher in comparison to standard lending options. Although This may be a downside, the accessibility and velocity of funding frequently outweigh the higher charges For lots of borrowers in urgent monetary conditions.

Doorstep hard cash lending, as the name suggests, requires the shipping of cash on to the borrower’s property. This assistance is made to cater to All those preferring in-man or woman transactions or individuals that may well not have usage of on line banking amenities. A agent with the lending corporation will take a look at the borrower’s household at hand in excess of the funds and, in many instances, collect repayments with a weekly or every month foundation. This personalized touch can offer a way of reassurance to borrowers, In particular people that could possibly be wary of online transactions or are fewer informed about electronic economical solutions.

On the other hand, one must think about the higher fascination rates and charges normally associated with doorstep hard cash lending. These kind of financial loans are regarded as superior-chance by lenders, given that they are unsecured Which repayment collection depends greatly to the borrower’s capacity to make payments over time. Hence, the desire charges charged could be significantly increased than Those people of standard loans. Borrowers must be careful of the, as the ease of doorstep funds lending may perhaps come at a considerable Price tag.

An additional element to think about may be the repayment overall flexibility that these loans provide. Quite a few open up door loans and doorstep money lending providers give versatile repayment possibilities, which may be useful for borrowers who will not be in the position to commit to demanding payment schedules. However, this versatility may also produce for a longer time repayment periods, which, coupled with substantial curiosity prices, could cause the borrower to pay significantly far more above the lifetime of the financial loan than they originally borrowed. It’s vital that you evaluate if the repayment framework of those loans is actually manageable and in step with one particular’s economic scenario before committing.

Among the list of essential components of open up doorway loans is their skill to accommodate persons with bad credit rating scores. Conventional banking institutions usually deny financial loans to These with less-than-fantastic credit score histories, but open doorway lenders often aim a lot more to the borrower’s present capability to repay rather then their credit past. Although This may be beneficial for people seeking to rebuild their economic standing, it’s important to be conscious on the dangers concerned. Failing to satisfy repayment deadlines can more problems one’s credit rating and potentially lead to much more serious economic troubles down the line.

The acceptance system for these financial loans is frequently speedy, with selections created within a number of several hours, and funds are sometimes offered precisely the same day or the next. This immediacy makes these financial loans a lifeline for men and women going through sudden expenses or emergencies, for instance auto repairs, health-related bills, or other unexpected monetary obligations. Nonetheless, the convenience of access to cash loans to your door pay weekly funds can sometimes bring on impulsive borrowing, which could exacerbate economical troubles as opposed to resolve them. Borrowers really should generally think about whether or not they certainly require the personal loan and if they will be able to manage the repayments ahead of proceeding.

Another advantage of doorstep funds lending is the fact it enables borrowers to receive dollars with no need to visit a bank or an ATM. This may be specially valuable for those who may possibly are now living in distant spots or have minimal usage of fiscal establishments. Furthermore, some borrowers may sense more snug coping with a representative in individual, particularly if they have got fears about handling monetary transactions on-line. The private character with the assistance can foster a stronger relationship amongst the lender and the borrower, nevertheless it is crucial to understand that the large expense of borrowing stays a significant consideration.

There exists also a specific standard of discretion involved with doorstep funds lending. For individuals who might not want to disclose their monetary problem to Other individuals, a chance to cope with personal loan preparations from the privacy in their household is often appealing. The personal conversation by using a lender representative may also provide some reassurance, as borrowers can go over any concerns or questions right with the person delivering the bank loan. This direct interaction can often make the lending approach feel considerably less impersonal than working with a faceless on-line software.

Over the draw back, the benefit of doorstep hard cash lending can in some cases produce borrowers getting out numerous financial loans concurrently, especially if they locate it demanding to help keep up with repayments. This will produce a cycle of financial debt which is challenging to escape from, especially In the event the borrower is not managing their funds cautiously. Responsible borrowing and a transparent comprehension of the bank loan phrases are important to steer clear of such cases. Lenders may perhaps present repayment strategies that appear flexible, nevertheless the large-desire fees can accumulate immediately, leading to an important credit card debt stress after some time.

Whilst open doorway financial loans and doorstep income lending offer various Gains, which include accessibility, velocity, and suppleness, they aren't without the need of their challenges. Borrowers must very carefully assess the conditions and terms of those loans to avoid receiving caught in the debt cycle. The temptation of rapid cash can sometimes overshadow the long-phrase economical implications, significantly Should the borrower is not really in a solid posture for making well timed repayments.

Amongst the key things to consider for any borrower must be the whole expense of the financial loan, including interest premiums and any added costs. While the upfront simplicity of those loans is appealing, the particular sum repaid with time may be appreciably better than expected. Borrowers should weigh the instant great things about receiving funds quickly versus the extensive-phrase monetary influence, especially In the event the mortgage phrases prolong in excess of several months as well as yrs.

Moreover, borrowers also needs to be familiar with any likely penalties for late or missed payments. Several lenders impose steep fines for delayed repayments, which often can further boost the full cost of the personal loan. This can make it far more significant for borrowers to make sure that they've got a strong repayment approach in place right before taking out an open door mortgage or opting for doorstep cash lending.

Despite the probable downsides, you'll find eventualities where open up doorway loans and doorstep funds lending is often effective. For people who want entry to cash immediately and do not have other viable economical choices, these financial loans give an alternative which will help bridge the gap throughout tricky instances. The important thing is to employ these loans responsibly and ensure that they're Component of a properly-imagined-out fiscal system rather then a hasty selection pushed by instant needs.

Occasionally, borrowers could find that these loans serve as a stepping stone to much more stable money footing. By building well timed repayments, men and women can demonstrate economical duty, which can increase their credit score scores and allow them to qualify For additional favorable personal loan terms Sooner or later. On the other hand, this consequence is dependent heavily on the borrower’s capability to control the loan proficiently and avoid the pitfalls of higher-curiosity credit card debt.

It’s also really worth noting that open doorway loans and doorstep dollars lending will often be subject matter to regulation by financial authorities in several nations. Lenders must adhere to selected recommendations regarding transparency, curiosity rates, and repayment phrases. Borrowers must be certain that they are managing a authentic and regulated lender to stay away from possible scams or unethical lending techniques. Checking the lender’s credentials and looking at reviews from other borrowers may help mitigate the risk of falling victim to predatory lending strategies.

In summary, open doorway financial loans and doorstep funds lending give a effortless and available Remedy for people struggling with quick economical issues. When the ease of obtaining these loans may be captivating, it’s very important to tactic them with warning and a transparent comprehension of the related costs and threats. Borrowers need to carefully Appraise their power to repay the financial loan within the agreed-on conditions and concentrate on the opportunity long-time period financial effects. By doing so, they could make knowledgeable selections that align with their money aims and steer clear of the common pitfalls of high-desire lending.

Jaleel White Then & Now!

Jaleel White Then & Now! Mara Wilson Then & Now!

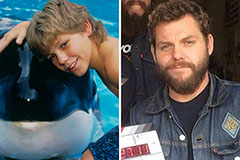

Mara Wilson Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!